Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Child Relief Claim allowed.

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

For public servants under the pension scheme combined relief up to RM7000 is given on Takaful contributions or payment for life insurance premium.

. The relief amount you file will be deducted from your income thus. The payments must be made between 1 March 2020 and 31 December 2020 to qualify for tax relief in YA 2020. Tax Relief for Individual Spouse i Education RM 7000 Education fee for tertiary level or postgraduate level ii Spouse Alimony RM 4000 For spouse without income Alimony.

Claims for this benefit is for the net deposit in SSPN up to the claim limit of your total deposit for the year 2020. Additional deduction for purchase. RM 2000 per child A little relief for.

Special relief in addition to lifestyle relief for purchase of mobile phone personal computer or tablets for YA 2020 and YA 2021. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to. Malaysias Minister of Finance MOF presented the 2021 Budget proposals on 6 November 2020 announcing a slight reduction in the individual income tax rate by 1 percent.

Thanks to the Economic Stimulus Package 2020 announced by Interim Prime Minister Tun Dr Mahathir Mohamad yesterday Malaysian can now to claim up to RM1000. Therefore take a look at whats new when it comes to filing your income tax for YA2020 compared to the year before. The personal income tax rate will increase for those earning chargeable income of more than RM2 million per year by 2 to 30.

Parents whove contributed can get a relief of up to RM8000 for their annual net savings total deposit in 2020 minus total withdrawal in 2020. Personal tax relief Malaysia 2020. Additional RM2500 relief for personal computer.

These Tax Relief Services Can Help. Unmarried Child Under Age. For YA 2021 extended until YA.

Tax Relief Help Help With IRS Back Taxes 2022 Top Brands Comparison Online Offers. For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of your aggregate income. 13 rows Assessment Year 2020 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

28 rows There are various items included for income tax relief within this category which are. Lifestyle Purchase of personal computer smartphone or tablet for self spouse or child and not for business use. Below is the list of tax relief items for resident individual for the assessment year 2019.

Purchases of supporting equipment for disabled self or dependants disabled spouse children or parents are eligible for a tax relief of up to RM6000. You can get RM9000 tax reliefs till then. Ad Drowning in Tax Debt.

These Tax Relief Services Can Help. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Tax Relief Help Help With IRS Back Taxes 2022 Top Brands Comparison Online Offers.

2500 Restricted 8. In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer. Ad Drowning in Tax Debt.

Books journals magazines printed newspapers sports equipment and. Moreover the accommodation premises must be registered. Meanwhile personal income tax rate for non.

The prime minister announced that personal income tax relief in the amount of MYR 1000 on travel expenses incurred from 1 March 2020 to 31 August 2020 is to be. Tax Rates for Individual. In late February this year it was announced under the 2020 Economic Stimulus Package that Malaysians who travel locally can enjoy special personal income tax relief up to RM1000.

There is also a separate tax relief for lifestyle expenses for sport activities. Get cash reimbursement instead of remuneration Fixed monthly allowances provided by your employer are taxable subject to your.

Income Tax Relief Items For 2020 R Malaysianpf

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Finance Malaysia Blogspot Personal Income Tax For Ya2019 What Life Insurance Category Changed

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

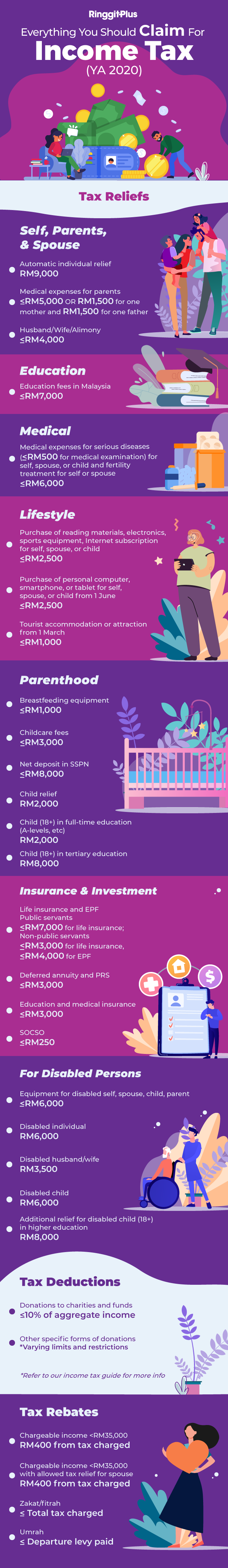

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Ttcs Insights To Budget 2021 Thannees

Finance Malaysia Blogspot Personal Income Tax Relief For Ya2020

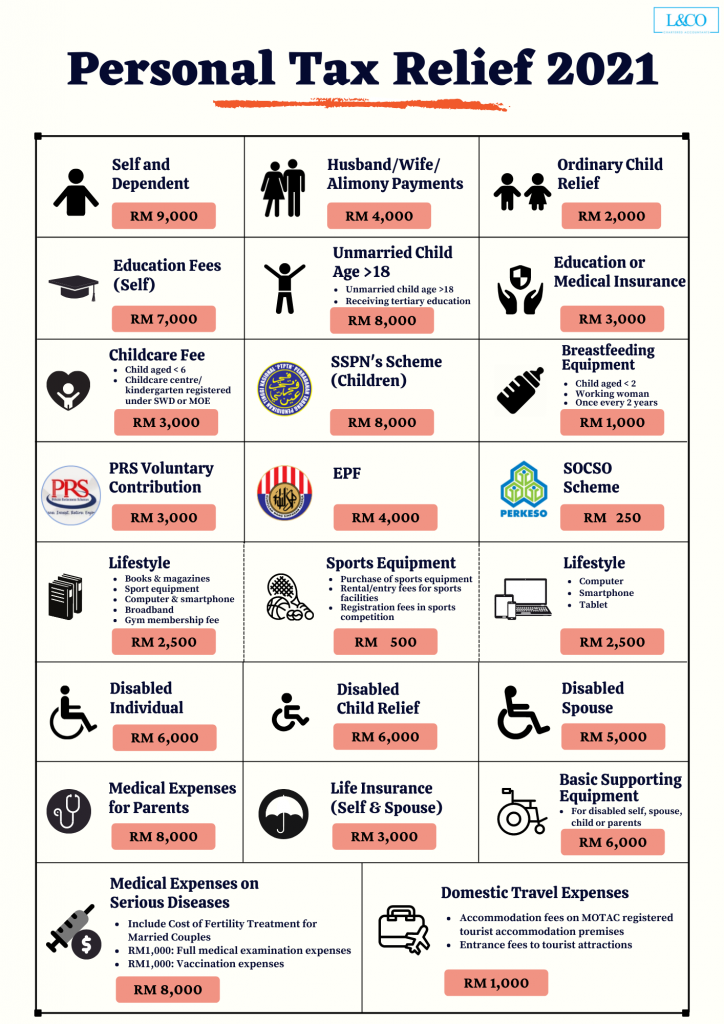

Personal Tax Relief 2021 L Co Accountants

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Malaysia Personal Income Tax 2021 Major Changes Youtube

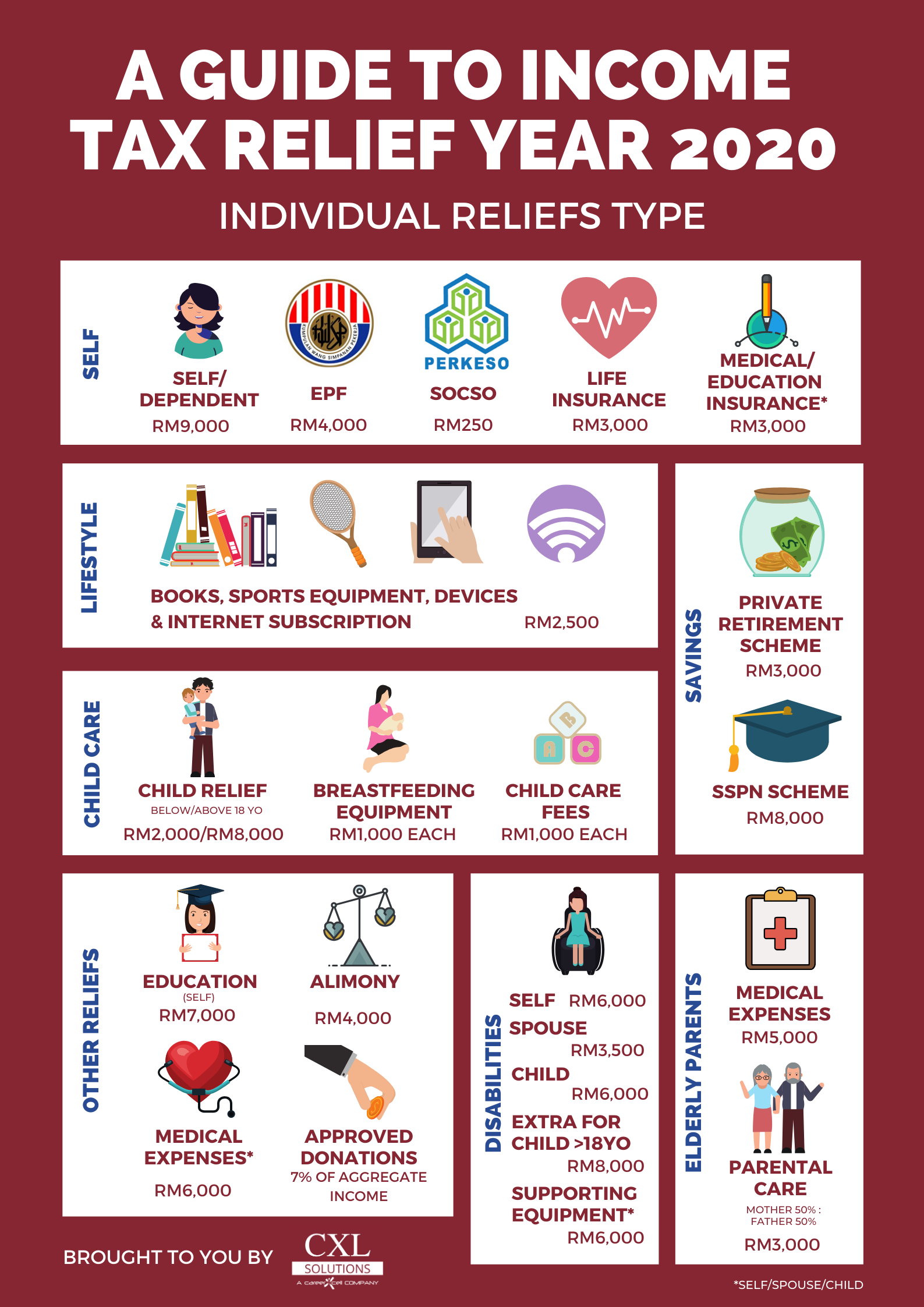

Ttcs Tax Reliefs Ya 2020 Thannees

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Sspn Tax Relief 2019 Gabrieltrf

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Lhdn Irb Personal Income Tax Relief 2020